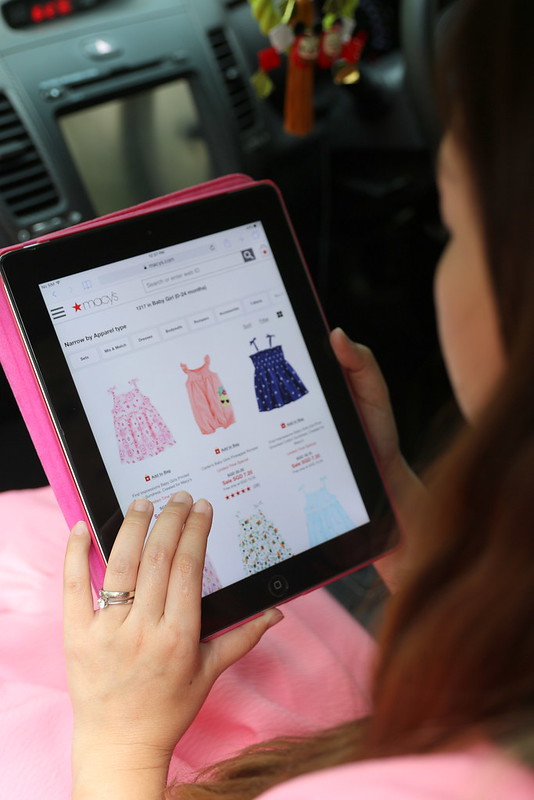

I love buying clothes for the girls through shopping online on sites that are based overseas because the range is very dynamic and the clothes are sometimes cheaper than what you find here in Singapore. What I dislike, however, is being subjected to poor foreign exchange rates and the so-called “hidden” currency conversion charges, which always leave me shell-shocked when I receive my credit card statements. I previously felt that I was at the mercy of the credit card companies and had absolutely no control over these extra fees, until I learned about the DBS Multi-Currency Account (MCA)! Of course, good things must share! 🙂

Do you know that with a DBS Visa Debit card linked to your MCA, you could save between 2.5% to 15% of forex fees and Dynamic Currency Conversion charges? Whoohoo! Not trying to make excuses here but it is truly another reason to shop online at your favourite overseas shopping websites! 😉

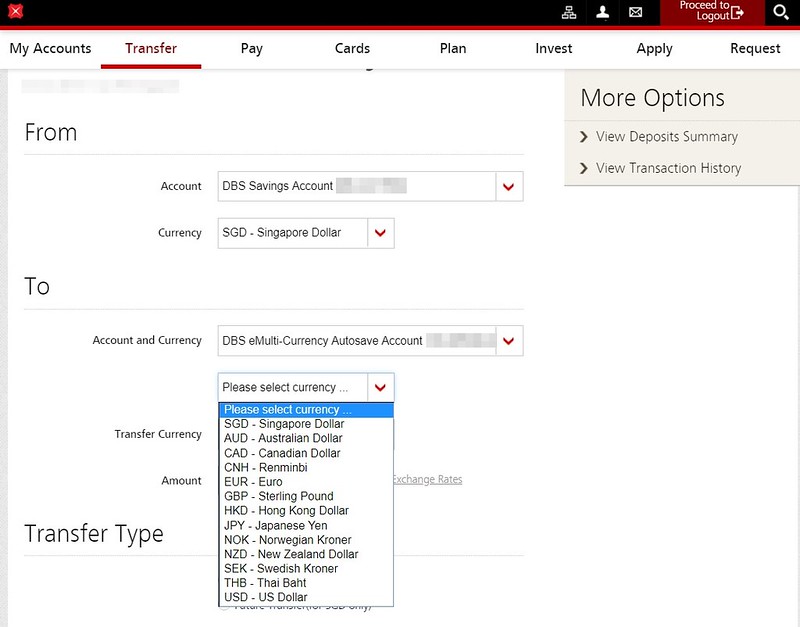

What exactly is DBS MCA? You can think of the DBS MCA as a versatile digital wallet where you can store your Singapore dollar and 12 different foreign currencies – Australian Dollar (AUD), Canadian Dollar (CAD), CNH (Renminbi – not available for debit card payments), Euro (EUR), Sterling Pound (GBP), Hong Kong Dollar (HKD), Japanese Yen (JPY), Norwegian Kroner (NOK), New Zealand Dollar (NZD), Swedish Kroner (SEK), Thai Baht (THB), and US Dollar (USD).

One of the biggest benefits of the DBS MCA, is the ability to buy and save currencies at your preferred rate, 24/7. Yup, that’s right! Unlike having no control over the foreign currency rates and conversion fees by the credit card companies, with the DBS MCA, you can enjoy full control and access to the above-mentioned currencies online, anytime and anywhere. If you feel that the rates are favourable, simply buy it, and lock-in the FX rate, and save the funds for your overseas online shopping later! It is like making a trip to the money changer, except that you can now purchase and store your foreign currencies online with the DBS MCA! Do not fret if you think that the rates are not favourable enough; you can set your preferred rate on digibank (DBS mobile app) and be notified with a FX rate alert as soon as your preferred FX rate hits! The time saved from rate watching can now be used on more online shopping. Yay! 😛

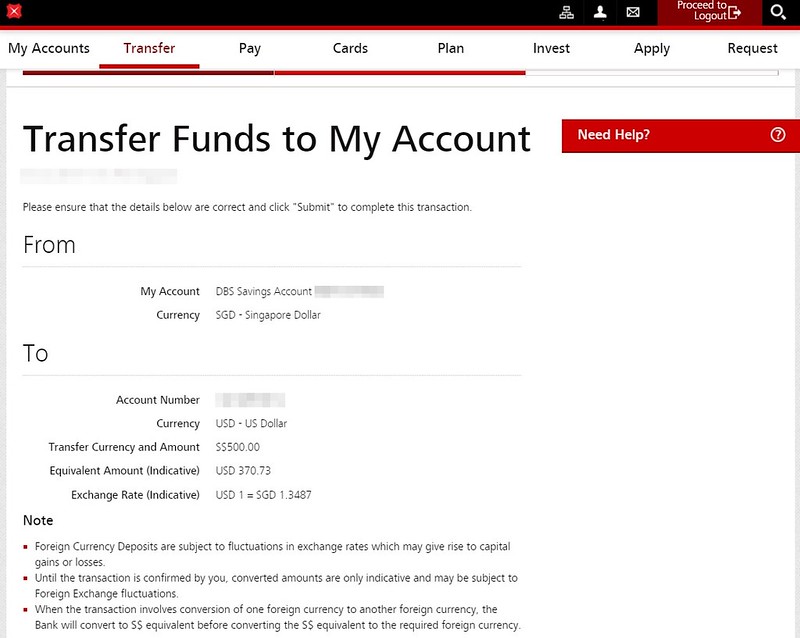

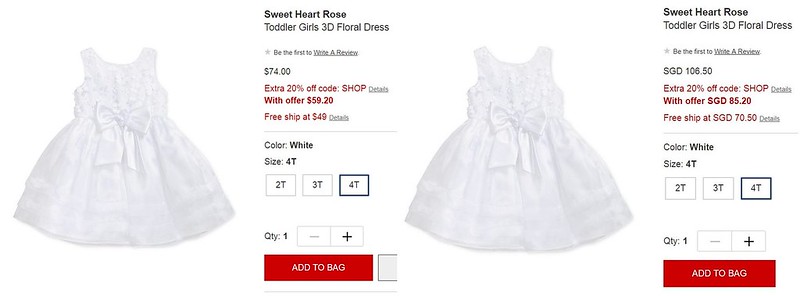

We will be attending a relative’s wedding this year and I was searching for the girls’ dresses on one of my favourite overseas shopping website, Macy’s. At its original price, this item which I am eyeing costs USD 74 or SGD 106.50, which means the conversion rate is USD 1 = SGD 1.439. Earlier on, I had already transferred close to 400 worth of US dollars into my DBS MCA when the rate was USD 1 = SGD 1.3487. With that USD in my DBS MCA, I can now use it to purchase this dress, without being subject to poor exchange rates and ridiculous conversion fees! Instead of paying SGD 106.50, I now only need to pay SGD 99.80, with savings of SGD 6.70! More money saved can be used to buy more clothes for the girls!

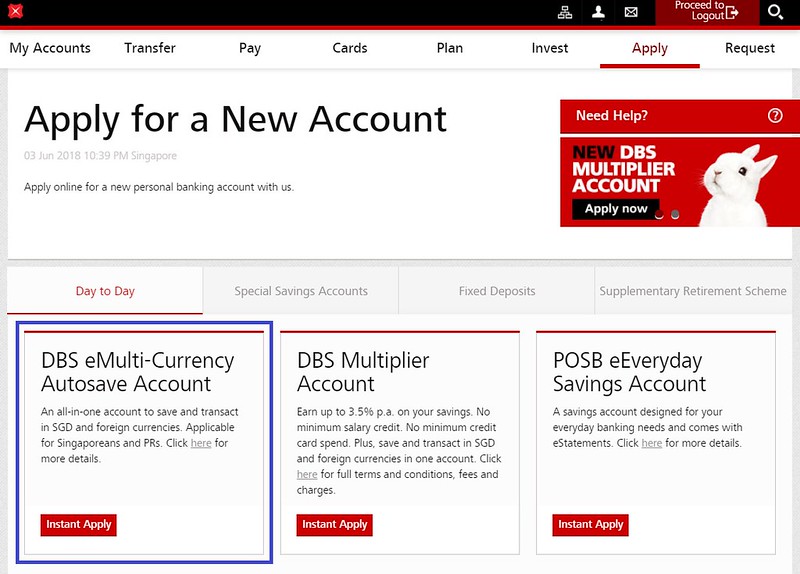

Applying for the DBS MCA is hassle-free and can be done in less than 5 minutes. Log in to your DBS digibank account and apply for a Deposit account. It takes up to 2 working days for your request to be processed. Mine was approved on the same day! Link your existing DBS Visa Debit Card to your MCA so that you can use it anytime and anywhere when it comes to online and overseas transactions! 🙂

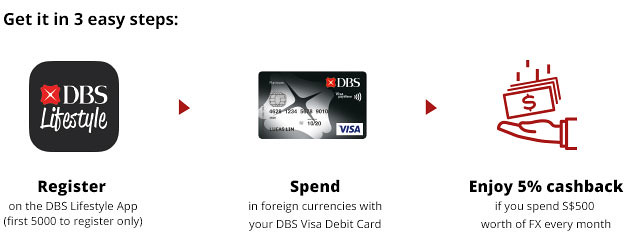

You’ll be glad to know that from 5 June to 31 August 2018, you get to enjoy 5% cashback with your DBS MCA and DBS Visa Debit Card when you spend in foreign currencies either online or overseas shopping!

Terms & Conditions apply. SGD deposits are insured up to S$75K by SDIC.